World Trade Organisation and the implications for Northern Ireland trade

During a House of Commons debate on Article 50 in February 2017, Brexit Minister, David Jones, confirmed that if the UK failed to secure a deal with the EU during negotiations, it would fall back on World Trade Organisation (WTO) terms of trade. This blog article outlines what the WTO is and how trading on WTO terms might impact NI trade position.

What is the World Trade Organisation?

The purpose of the WTO is to ‘open trade for the benefit of all’. The organisation, which consists of 160 countries, is a forum for trade negotiations that administers trade agreements and settles trade disputes.

In the context of Brexit, a trading relationship based on WTO terms represents a definitive break from the EU, offering no preferential access to the single market. Equally, it would place no obligation on the UK to implement EU legislation, nor would the UK be required to contribute to the EU budget or to accept the free movement of people. From a trading perspective, UK firms wishing to export to the single market would still have to comply with EU rules such as product standards.

Tariff implications

Removing the UK’s preferential access to the single market would introduce trade tariffs where there are currently none. WTO rules on tariffs are based on the ‘Most Favoured Nation’ principle. This principle seeks to ensure non-discrimination in the tariffs one country applies on another. The principle holds that, with the exception of free trade agreements, the tariff applied by a country on exports from the ‘Most Favoured Nation’ (MFN) must apply to all other countries

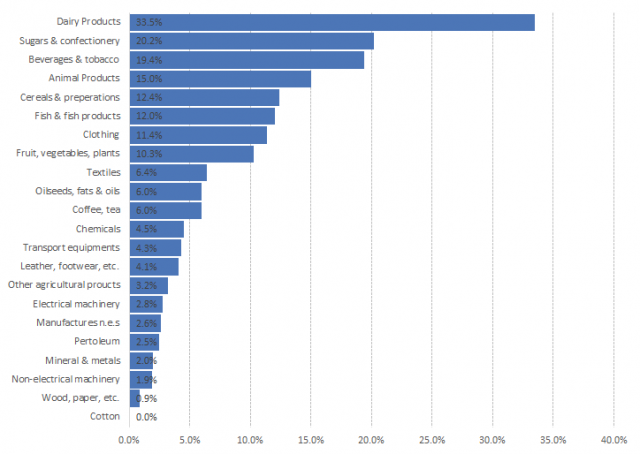

According to the House of Common’s Library, in a WTO scenario ‘MFN tariffs would be imposed on around 90% of the UK’s goods exports to the EU by value’, though the implications ‘would vary considerably by sector’. WTO data shows that the simple average of MFN tariffs charged by the EU in 2015 was 5.1%. This masks a complex range of MFN tariffs. For example, the simple average tariff on agriculture products was 10.7%, compared to a 4.2% average tariff on non-agricultural goods.

Figure 1 presents average MFN EU tariffs for a range of products groupings. Products falling within these groupings have their own specific tariffs. For example, the average tariff for tobacco and beverages in Figure 1 was 19.4%. Within this broad category there are a range of products with varying tariffs – tobacco products had a 74.9% tariff: in contrast mineral water was tariff free. MFN arrangements allow for a certain proportion of products to be traded without duty, these also vary by product.

Overall the WTO tariff system is complex – WTO data identifies over 6,000 EU MFN tariff lines, with certain tariffs expressed as a percentage and others as a Euro charge per specified volume of weight. Under a WTO relationship, NI firms exporting to the EU will be required to navigate this new complexity.

Given the complexity of WTO tariffs, it is difficult to estimate the impact of defaulting to these terms on NI trade. It is likely the imposition of tariffs on NI products sold to the EU would make certain products more expensive within this market. Conversely, import tariffs are likely to increase input prices for businesses and impact on consumers. It is uncertain the extent to which tariffs would be counteracted by the devaluation of Sterling, or how long this devaluation would continue. Moreover, it is currently unknown as to what extent the UK Government would consider it desirable to raise import tariffs to protect certain sectors from global competition.

Free trade agreements

A further complication of Brexit on WTO terms only, would be the UK’s non-continuance with EU free trade agreements extending to third countries and regions. The European Commission website currently lists 44 agreements that the UK is party to by way of its EU membership (five additional agreements are finalised but not yet applied). The majority of these agreements (39) are of a type that seek to minimise or eliminate tariffs. Should the UK leave the EU and fail to secure replacement agreements with these countries, trade between the UK and these markets will also be conducted under WTO terms.

EU Standards

A UK/EU relationship based on WTO rules, would mean the UK is no longer subject to EU regulations. Firms exporting to the EU would still be required to meet EU standards in order to sell into the single market. At present firms exporting to the EU are compliant with the EU standards as the UK’s product regulation system is harmonised with the EU’s. Should the UK diverge from the EU standards in the future, exporters may be required to ensure their goods are compliant prior to entering the single market.

At present, it seems unlikely that the UK would choose to diverge from EU standards. The recent White Paper on ‘The United Kingdom’s exit from and new partnership with the European Union’ states the UK Government will seek to ensure that the British Standards Institution continues to play a ‘leading role in driving the development of international standards’ and that the UK’s ‘future relationship with the European Standards Organisations continues to support a productive, open and competitive business environment in the UK’. On the issue of international standards, the House of Lords European Select Committee recently highlighted the ‘important role’ the EU has played in setting global standards that have been accepted by third countries.

Customs

A WTO based EU/UK relationship would result in the UK leaving the customs union. Firms trading with the EU from outside of the customs union are subject to customs checks. This could be particularly problematic for Northern Ireland, as the region shares a land border with the EU and around 37% of our exports cross that border to enter the RoI. Although the UK Government has stated that it wishes to ‘retain free and frictionless’ trade across the Irish land border and that it is seeking to develop a ‘mutually beneficial new customs agreement with the EU’, in the absence of an agreement between the UK and the EU it is unclear how realisable either of these outcomes would be.

WTO Membership

The UK’s WTO status is uncertain. In May 2016, the Director General of the WTO, Roberto Azevêdo, noted that the UK joined the WTO as an EU Member State and that the UK’s WTO membership had been shaped by decades of EU-WTO negotiations. The Director General stated that:

Pretty much all of the UK’s trade [with the world] would somehow have to be negotiated.

The UK, for its part, has begun the process of preparing its WTO membership terms ahead of Brexit negotiations. In a written statement to Parliament, International Trade Secretary Liam Fox said:

In order to minimise disruption to global trade as we leave the EU, over the coming period the Government will prepare the necessary draft schedules which replicate as far as possible our current obligations.

These schedules would require the agreement of other WTO members. In December Reuters reported that trade experts were of the opinion that this would be a relatively straightforward process in all areas apart from agriculture. It is unclear as to what the precise impact this additional uncertainty would have on an already ambiguous situation.