Yesterday, in the House of Commons, the Chancellor of the Exchequer announced some changes to the United Kingdom (UK) Government’s spending plans based on the latest economic data. What does this mean for Northern Ireland (NI)?

Autumn Budgets are the way ahead

After 20 years of consecutive Spring Budgets, the Chancellor has unveiled his first Autumn Budget. This is the second budget of 2017, and marks a change in the UK Government’s usual budgeting schedule. It puts distance between the Chancellor’s Budget and the financial year end. His Statement outlined spending plans and a series of taxation proposals, based on his view of the UK’s current economic position. This view is reflective of the Office for Budgetary Responsibility’s (OBR) recent downward revision of the UK’s growth figures. The spring forecasts projected growth of 2%, however this has now been reduced to an average of 1.5% over the next 5 years. Weakened productivity performance is cited as the inhibiting factor. This challenging economic backdrop has shaped the budget, which is unlikely to have startled many.

So how will NI funding be affected?

Many of the tax policies announced by the Chancellor concern non-devolved matters but will still directly impact upon people in NI, such as VAT (Value Added Tax) and income tax thresholds. His spending allocation to NI also will impact people who live here, as it largely determines the NI Executive’s annual ‘funding envelope’ – its ’block grant’ – for the areas in which it has responsibility to set policy and make decisions. (To learn more, see one of our previous briefing papers on Barnett consequentials).

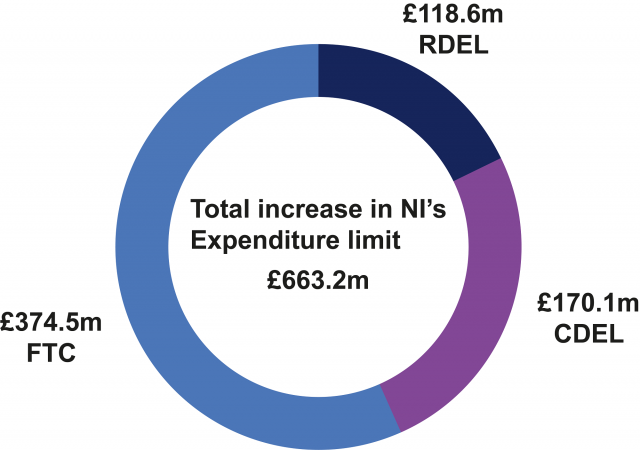

The additional resources due to NI from the Budget total £660 million, however this figure warrants some qualification. Figure 1 shows that only a small proportion of the additional funding is Resource DEL (RDEL). RDEL is used by public bodies for day-to-day spending on running costs – i.e. salaries, heating and lighting. Instead, a majority of the additional resources allocated are to be used for capital investment – i.e. the purchase or development of assets, such as buildings, or machinery. From an economic perspective, capital spending is generally considered beneficial because it adds to the stock of infrastructure for many years. The immediate and widely reported funding needs of the Health Service however, are related to RDEL. So these additional funds will not significantly assist to alleviate these pressures or to lift the public sector pay cap.

A second issue is that capital funding is split into two kinds – conventional Capital DEL (CDEL) and Financial Transactions Capital (FTC). CDEL is typically used to invest in public assets like roads or school buildings. FTC funding however, has proved more difficult to use. This was discussed in a previous blog article FTC: What is it, and how can it be used?. In the context of yesterday’s Budget, this is important because more than half (about 57%) of the additional £660 million is FTC. If the public sector has difficulty in finding appropriate uses for this additional funding, the benefits to NI from the Chancellor’s spending plans will be reduced.

The following sections look at key areas of the Chancellor’s Budget from a NI perspective.

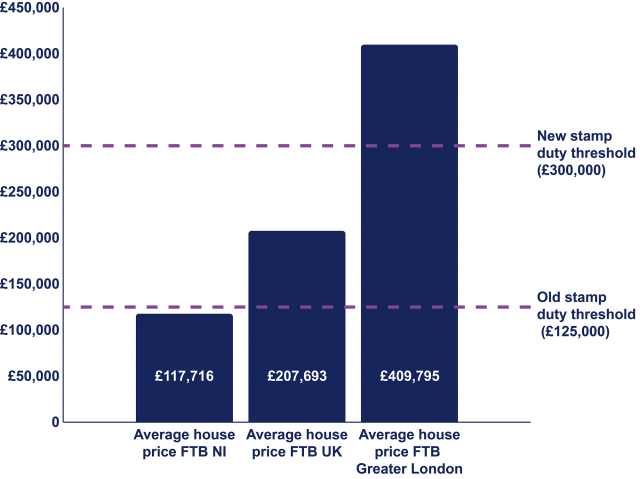

Few NI beneficiaries from Stamp Duty changes

The Chancellor’s policy announcement which has attracted most attention is the change to stamp duty for first time buyers (FTBs). Previously FTBs (and everyone else) had to pay stamp duty on any house purchased over a value of £125,000. This has been increased to £300,000 for FTBs, in a bid to enable people to make the first step onto the property ladder. This policy will have most impact in London and surrounding areas where house prices are highest. Scotland and Wales have their own devolved systems for stamp duty; however NI follows the same rates as England.

Figure 2 illustrates that the impact upon NI FTBs is anticipated to be very low. According to a Halifax report, the average FTB house value in NI is under £118,000, whilst in London this figure is almost £410,000. The UK average is £208,000.

How will the budget impact on NI households?

The vast majority of NI workers pay tax on earnings at the basic rate above the personal allowance tax-free threshold. This allowance is set at £11,500 for the 2017-18 financial year. In their manifesto, the Conservatives pledged to uphold their previous commitment to raise this allowance to £12,500 by 2020. This Budget sees the allowance increase to £11,850 in April 2018, meaning the average worker earning over £11,850 will pay £70 less income tax per year.

Another Conservative manifesto pledge was to increase the higher rate tax band to £50,000 by 2020. This Budget has announced that the band will increase from £45,000 to £46,350 in April 2018, meaning a saving of £270 per year for NI workers earning over this amount.

A recent London School of Economics (LSE) Centre for Economic Performance report stated that increased inflation, following the Brexit vote, has resulted in an average effective pay cut of £448 for UK workers. The report also highlighted NI as the worst hit region by the post-referendum inflation; whilst London has been the least affected region. This suggests that the net benefit to NI households from the Chancellor’s tax reduction will be lower than for other UK taxpayers.

The National Living Wage is also changing in April 2018, increasing by 4.4% from £7.50 to £7.83. The Low Pay Commission reported in 2017 that NI has the highest proportion of minimum wage workers in the UK (12.9% compared to a UK average of 8.5%). Therefore, whilst NI may have the highest proportion of workers benefiting from the living wage increase, it is only by virtue of having so many of the lowest paid workers in the UK.

Were there any policies specific to Northern Ireland?

Yes, there were some items in the Budget which directly relate to NI, and some others which relate to all the devolved administrations. Here are five:

- Corporation tax matters: The UK Government has reinforced its commitment to devolving corporation tax matters to the NI Executive. This is subject to restoration of devolution, but could represent a significant opportunity for the NI Executive, particularly following Brexit. It is worth noting that for now, the VAT threshold for small business has been locked at £85,000 for two years. This means that small businesses and sole traders in NI which are beneath the threshold will not have any additional administrative burden relating to VAT.

- ‘City Deal’ for Belfast: The Chancellor has announced that he is prepared to start formal negotiations to enter into a ’City Deal’ for Belfast. Rather than entailing additional funding, such a deal would be likely to result in increased freedom and devolved responsibility at council level to make commercial decisions. Such a deal could potentially pave the way for further deals for NI cities. Commencement of negotiations is also subject to restoration of the NI Executive.

- Tourism: The UK Government has pledged to issue a call for evidence in early 2018 regarding the impact of VAT and Air Passenger Duty on the tourism industry in NI. A report on the issue can be expected in 2018.

- Money from banking fines: £5 million of banking fines are to be divided between the devolved administrations. The recipient projects in Scotland and Wales provide support for veterans, whilst the project in NI supports injured police officers and their families.

- Barnett Formula and consequentials: There have been a number of calls in recent years to increase transparency around the outworking of the Barnett formula and its consequentials. In response to this, the Chancellor has announced that the government will publish a breakdown of the changes by the end of the year. The devolved administrations can expect a similar report to be published every year going forward – an announcement likely to be welcomed by many.

What about the DUP-Conservative deal?

Finally, the Budget does not include information on the release of any of the additional funding from the ‘confidence and supply’ deal between the DUP and the Conservative Party. The most recent developments in respect of this money was issued by the NI Secretary of State, as he announced the 2017 NI Budget last week. In his Budget speech in the House of Commons, he indicated that any money released would be required to be authorised by Parliament by way of the estimates process in early 2018.