This article unpicks key recent developments relating to public finance in Northern Ireland (NI), while there is no functioning Executive or Assembly and there is no direct rule from the United Kingdom (UK) Parliament. Those developments include the NI Secretary of State’s separate Statements on 8 and 12 March: the first outlined her proposed 2018-19 Budget Allocations for NI; and, the second spoke more generally about NI public finances. Both sets of proposals are subject to the approval of the UK Parliament.

On 20 and 21 March, seeking to implement these proposals, the Secretary of State introduced two bills in the House of Commons, which now have progressed to the House of Lords. In sum, the bills collectively aim to enact measures that will serve a number of purposes relating to NI public finance given ongoing political circumstances. This article focuses on the following aspects of each bill:

- Bill 1: Provisions included within Northern Ireland Budget (Anticipation and Adjustments) Bill 2017-19 that seek to ensure funding is available to the NI Civil Service for the remainder of 2017-18 and for the start of 2018-19 (45% of allocated funding), and thereby continue public service delivery in NI. But as the House of Commons Library Briefing Paper about the Bill states, the Bill ‘…does not constitute the setting of a budget for the Northern Ireland Assembly’.

- Bill 2: Clauses stated within the Northern Ireland (Regional Rates and Energy) Bill that aim to make provision for striking the Regional Rate in NI for 2018-19.

So what considerations arise from these recent developments?

In no particular order of significance, the following paragraphs highlight points worth considering:

1. Comparison of allocation baselines for 2017-18 and 2018-19

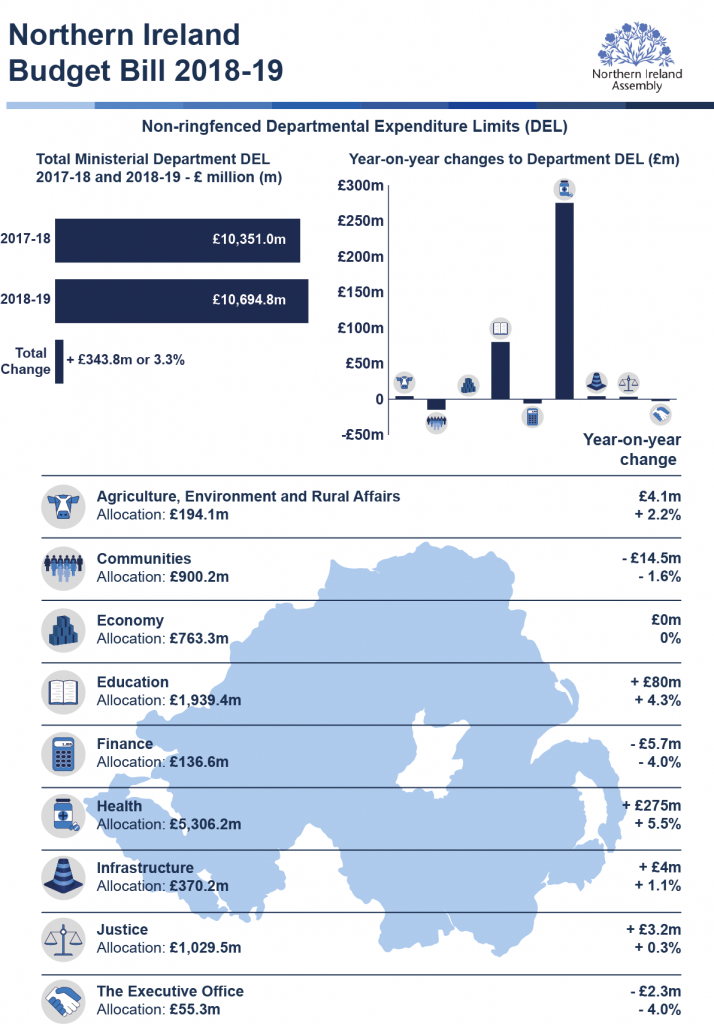

Figure 1 below sets out the headline changes to the allocation baselines for departments’ day-to-day spending (known as ‘Non-ringfenced Resource DEL’ (Departmental Expenditure Limits)). It compares the proposed Allocations for 2018-19 against those that had been made for 2017-18. This comparison identifies a 3.3% overall increase in these day-to-day spending allocations across the NI public sector, providing an indication of the funding that will be available for future public service delivery in NI.

(It should be noted that the proposed Allocations also include Capital DEL budgets for departments to invest in assets – such as buildings roads and equipment – but these are not considered here.)

When comparing the baselines – as shown in Figure 1 – it should be noted that the figures are taken from the March 2018 Department of Finance (DoF) publication 2018-19 Northern Ireland Finances – Tables, which sets out 2017-18 baseline figures. Those figures exclude items such as in-year additions, European Union (EU) match funding and technical transfers with Great Britain (GB) departments. Arguably, such exclusion allows for a truer comparison of year-on-year changes, without distortions – if any – arising from discretionary in-year monitoring allocations and temporary funding allocations, e.g. the Voluntary Exit Scheme for public sector workers.

It also should be acknowledged that this approach may make it appear that some NI departments are receiving a larger increase in their proposed allocations for 2018-19 than when compared to their total spending for last year.

For example, the March 2018 DoF publication states that the NI Department of Education’s (DE) allocation is £1,939.4 million for 2018-19; an £80 million (4.3%) increase when compared to the DE’s 2017-18 baseline of £1,859.4 million. However, on 15 January 2018 the DoF noted in its Final Update on 2017-18 Financial Position for NI that Education was to be allocated an additional £14 million for 2017-18. This additional money was amongst the various sums excluded from the 2017-18 baseline figure. (Note that this money appears to be separate from the Conservative – Democratic Unionist Party Confidence and Supply Agreement money – £20 million – that was drawn down by the DoF in 2017-18 in relation to health and education – see below at point 7.)

Another example concerns the NI Department of Health (DoH) figures in the March 2018 DoF publication. At Table 3, it states that the DoH is receiving a 5.5% increase from baseline to 2018-19 allocation. However, below in a footnote, the DoF further states that the:

…DE and DoH have a 0% and 2.6% uplift respectively against the comparable 2017-18 budget including relevant in-year allocations.

Challenging as it is to report public finances, the above presentation of figures in the absence of additional detail, e.g. fuller explanation in the form of accompanying explanatory notes explaining the tables, makes like-for-like comparisons difficult.

Nonetheless, it should be noted that the approach taken by the DoF is similar to that taken by the Treasury in Spending Review documentation, where the Treasury excludes ‘one-off and time-limited expenditure’ from Great Britain department and devolved administration baselines.

2. Health spending

Health Spending accounted for 48.2% of NI’s day-to-day spending in the 2017-18 baseline. The NI DoH Allocation of £5,306.2 million for 2018-19 represents 49.2% of the total NI Allocations – an increase of one percentage point. All other things being equal, it appears from the current proposals and the prior trend that Health will consume more than half of NI’s day-to-day spending from 2019 onwards.

3. Education spending

Education Spending accounted for 17.8% of NI’s day-to-day spending in the 2017-18 baseline. The NI DE Allocation of £1,859.4 million for 2018-19 represents 18.0% of the total proposed NI Allocations – an increase of one fifth of a percentage point compared to the baseline. In other words, there is only a very marginal increase in the relative priority afforded to DE as a proportion of the total funding allocated by the Secretary of State in her proposals.

4. Higher and Further Education spending

The NI Department for the Economy’s (DfE) 2018-19 Allocation of £763.3 million matches its 2017-18 baseline. This means there is no cash increase from last year. In real terms this ‘flat cash’ allocation represents a cut to DfE; leaving the DfE to distribute its resources accordingly, e.g. higher and further education colleges may not receive additional funding.

5. Reclassification of Capital DEL to Resource DEL

The Secretary of State’s 8 March Statement explained that £100 million of existing capital DEL funding would be reclassified to resource DEL (if authorised by the UK Parliament). Such a reclassification would mark a departure from long-established practice and the Treasury’s Consolidated Budget Guidance, which states:

…departments may not switch provision from capital budgets to resource budgets; such switches would mean that money that had been earmarked for investment was used for current spending.

6. Domestic regional rates

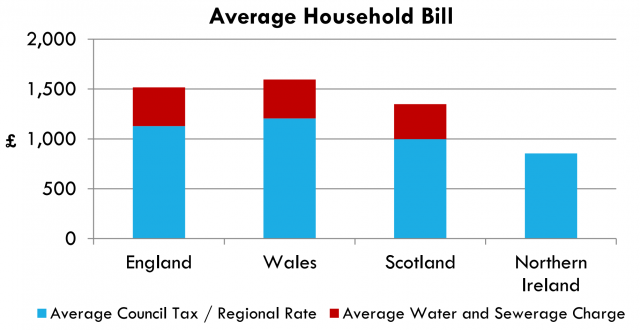

For a number of successive budgets, the Assembly has maintained increases in the Domestic Regional Rate (DRR) paid by homeowners, to the level of inflation. In December 2017, DoF published a Briefing on NI Budgetary Outlook 2018-20, which at page 30 illustrated the average NI household bills compared to other UK jurisdictions:

The Secretary of State departs from this trend of inflation-only rises in relation to the DRR, and instead increases the DRR by 4.5%. The Northern Ireland (Regional Rates and Energy) Bill 2017-19, introduced in the House of Commons on 21 March, seeks to enact this increase.

(Further information relating to these legislative proposals can be found in a recent RaISe blog article, What are rates and why do we pay them?)

7. Confidence and Supply Agreement funding

The Secretary of State’s proposed Allocations include £410 million from the Confidence and Supply Agreement; but that money is subject to ‘…Parliament’s full authorisation’.

The Northern Ireland Budget (Anticipation and Adjustments) Bill 2017-19, introduced in the Commons last week, marked the Secretary of State’s move to secure the enactment of that authorisation. The Bill provides £20 million of Confidence and Supply Agreement funding ‘to address immediate health and education pressures’ in 2017-18. (This money appears to be separate to the £14 million mentioned above at point 1.)

The Bill, however, did not contain any other Confidence and Supply Agreement funding. Such remaining earmarked funding will be debated by the UK Parliament at a future date, as noted by the Secretary of State when introducing the Bill:

…[the Bill] is not concerned with any of the £410 million set out in my budget statement, which will be a matter for the UK estimates in the summer, and for a Northern Ireland budget Bill thereafter.

8. Scope of Permanent Secretaries’ power to make spending decisions

The Secretary of State’s 8 March Statement proposed departmental Allocations for 2018-19 in the absence of the Executive and the Assembly in NI.

Her Statement acknowledged that:

Permanent Secretaries cannot […] take the full range of decisions that would be available to Ministers.

The Statement, however, failed to explain the scope of the Permanent Secretaries’ power when taking departmental spending decisions while there is an absence of either devolved government or direct rule in NI. Similarly, the Northern Ireland Budget (Anticipation and Adjustments) Bill 2017-19 – the first Bill the Secretary of State introduced in the Commons on 20 March – does not specify the scope of that power. So what is the scope of that power; how far does it extend?