As Northern Ireland (NI) emerges from the widespread COVID-19 public health crisis into a phase of more localised outbreaks and disruption, there have been numerous bleak economic developments. Claimant counts are sky high; output is in the doldrums; redundancies are increasing. There is concern that the burden has disproportionately fallen on workers in certain more vulnerable sectors – such as hospitality and retail.

There are indications that we are seeing more severe impacts on the predominantly younger people who tend to work in these sectors. The additional vulnerability of these sectors for workers is because, unlike office jobs, they cannot be done from home. Additionally, the sectors are extra-susceptible to social distancing requirements and limits on numbers of people meeting and mixing.

But is it all bad news? There have been one or two high profile good news stories. For example, the NI-based tech firm Kainos ‘traded strongly’ and repaid its furlough scheme money to the UK Government. Broadly speaking, however, this seems to be something of an unusual experience for a NI-based firm.

This blog article aims to give some indications of where (geographically and/or sectorally) particular issues have arisen, or may pose specific challenges as the UK Government’s furlough scheme continues to wind up. Many have expressed concerns that the totality of employment impact of COVID-19 will only be seen as the consequences of furlough ending feed through into the economy. At the same time, some planned easements of lockdown restrictions have been delayed – differently across different parts of the UK and the Republic of Ireland (RoI) – and even tightened again in particular localities.

The Global Picture

The Organisation for Economic Co-operation and Development’s September 2020 interim forecast found that:

Global GDP is projected to decline by 4½ per cent this year, before picking up by 5% in 2021. The drop in global output in 2020 is smaller than expected, though still unprecedented in recent history.

In the Eurozone, the press reported that recent economic data have suggested that confidence among the region’s consumers and businesses had started to wane. Following the easing of restrictions, confidence had begun to return, even though economic activity remains as much as 10% below its level at the start of the year. But now, it seems confidence is softening. As of 24 September 2020, Spain and France had reported nearly 1.2 million COVID-19 cases in total, and the 14-day case notification rate for the EU/EEA and the UK and was increasing for each of the 63 days to 20 September. These figures help to explain falling consumer confidence.

Closer to home, it was widely reported in the press in August that the UK has fared especially badly relative to other G7 nations. Of course, the full picture for 2020 will not be available for some time, yet indications at this point are:

Britain has now recorded the largest fall in GDP of any major country as well as the highest excess death rate in Europe.

The Northern Ireland picture

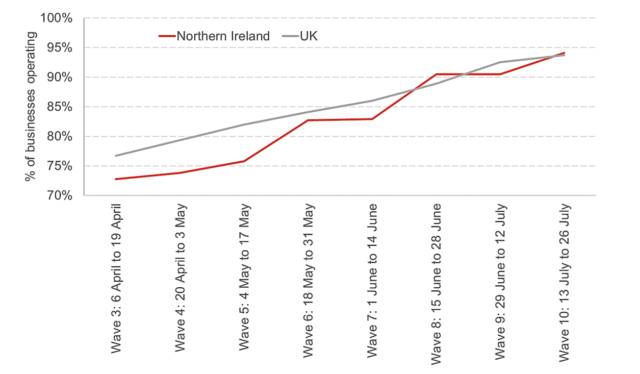

From early on in COVID-19, the Office for National Statistics (ONS) conducted a Business Impacts of Coronavirus Survey (BICS). Figure 2, below, shows that week-by-week a smaller proportion of NI-based businesses were open than in the UK as a whole (excluding Waves 8 and 10). Or, as the Fraser of Allander Institute put it:

…there was a higher level of business closure in Northern Ireland than the UK average.

To an extent, it is likely that these data are effected by the different speeds at which various lockdown restrictions have been imposed and/or relaxed by the different UK authorities. While acknowledging that, it is interesting to note that Figure 2 suggests a narrowing of the gap between NI and UK as a whole from the end of Quarter 2 (i.e. 30 June). It will be interesting to see if that pattern continues into the Quarters 3 and 4 of 2020.

The main purpose of Figure 2, however, is to show that between 6 and 19 April – when COVID-19 was reaching its peak in NI – more than a quarter of NI firms were not operating. Of course, this was an inevitable consequence of the lockdown: workers were to stay at home, and many businesses were required to close their doors.

The outworking of these requirements was the prioritisation of public health over economic activity. So, output dropped severely. Ernst & Young (EY) forecasted in August that NI GDP will fall 10.4% in 2020 and jobs are predicted to fall by over 4.2% (38,000).

A more localised picture

The Economic Policy Centre at Ulster University (UUEPC) published estimates of declines in Gross Value Added (GVA) at a district council level. Table 1, below, also shows the relative decline following the 2008-09 financial crash.

| Council district | Full year % decline, estimated 2020 | % decline in GVA 2008-09 |

| Mid Ulster | 16.3% | 15.6% (1) |

| Mid and East Antrim | 15.2% | 3.9% (11) |

| Causeway Coast and Glens | 13.3% | 10.5% (2) |

| Newry, Mourne and Down | 12.0% | 8.6% (6) |

| Fermanagh and Omagh | 11.9% | 7.6% (7) |

| Northern Ireland | 11.6% | 7.2% |

| Antrim and Newtownabbey | 11.5% | 10.3% (3) |

| Belfast | 10.6% | 5.8% (8) |

| Ards and North Down | 10.6% | 10.1% (4) |

| Armagh City, Banbridge and Craigavon | 10.6% | 9.4% (5) |

| Derry City and Strabane | 9.5% | 4.5% (10) |

| Lisburn and Castlereagh | 9.3% | 5.6% (9) |

Table 1: Estimated 2020 GVA decline compared to 2008-09; source: UUEPC (2020)

It is immediately clear that based on the numbers shown in Table 1, the UUEPC estimates that the decline in GVA will be greater in every part of NI than it was in 2008-09. It is also of interest that these estimates show less geographical variation than the 2008-09 decline. The range in estimates for 2020 is 9.3% to 16.3% (i.e. 7 percentage points), compared to 3.9 to 15.6 (i.e. 11.7 percentage points). It seems likely that those areas with the largest projected falls have an industrial mix that is more vulnerable than those areas with smaller projected declines.

Sectors

Family firms

A 2016 RaISe publication noted that the NI economy, in common with most European economies, consisted of a high proportion of micro businesses (i.e. fewer than 10 employees), and has done so for many years. Recent (2020) research by the Institute for Family Business/Oxford Economics on ‘family firms’ (i.e. there is family ownership, involvement in management, generational transfer and governance) shows that, relative to the UK as a whole, NI relies on these firms for a higher share of private sector employment – see Table 2, below.

| Country/region | Private sector employment (thousands) | Family firm employment as a share of private sector employment |

| England | 24,384 | 51.1 |

| Scotland | 1,705 | 52.4 |

| Wales | 872 | 62.1 |

| NI | 539 | 57.1 |

| UK | 27,500 | 51.6 |

Table 2: Proportion of jobs in family firms in parts of the UK; source: Institute for Family Business/Oxford Economics (2020)

This particular reliance on smaller firms may be important looking at how firms, and employment, are impacted by COVID-19. Oxford Economics noted:

SMEs have been particularly hard hit; the Office for National Statistics survey data shows that those SMEs that continued trading during the pandemic fared worse than their larger counterparts.

Therefore, if smaller firms are known to be more vulnerable to COVID-19-related effects, the higher-than-UK-average share of jobs in family firms in NI, may suggest a more significant impact on NI jobs than in the UK as whole.

Young people

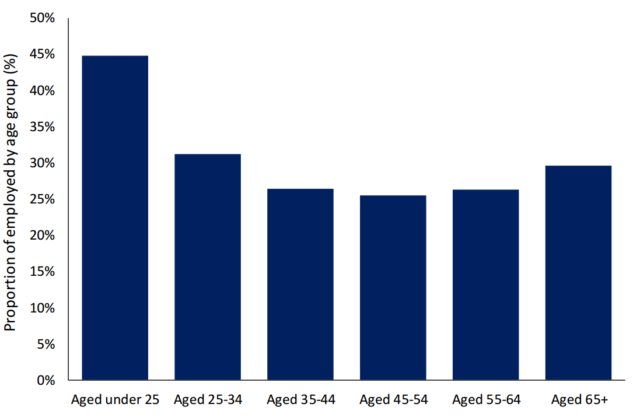

Research into impacts of COVID-19 on the NI labour market suggests that younger people have suffered the worst, and most likely will continue to do so.

By quite some margin, this suggests that under 25s were most likely to be affected by either the loss of their job, or the interruption of their employment. This finding is in line with other research undertaken in other parts of the UK, which found that ‘younger people appear to be taking the hardest hit’.

This is thought to be because a greater proportion of younger people work in low-paid jobs which cannot be done from home, such as in food service and other retail outlets. Younger people are also most likely to be furloughed (and therefore automatically taking an initial 20% pay cut because the scheme paid only 80% of usual earnings). This has, unsurprisingly, translated into increases in the claimant count for worklessness-related benefits in the period from February to May 2020, according to the Department for the Economy’s June 2020 report:

…workers under 50 years old saw their Claimant Count levels rise by 129%, as opposed to a rise of 80% for those over the age of 50.

Older people

Whilst it is apparent that younger people have been exposed to a disproportionate effect from COVID-19, Figure 3 also suggests that older workers were also vulnerable. Logically, this makes sense: older people are more likely to have long-standing medical conditions that make them at higher risk from the disease. Such an effect has been shown in a number of studies finding that:

…employment impacts have been concentrated among the youngest and oldest workers.

Women

COVID-19 has had an uneven impact on men and women in NI. For example, over the February to May 2020 period, Male Claimant Count levels increased by 136%, from 18,546 to 43,815. Female Claimant Count levels, meanwhile, jumped 92% to 21,336. But, the impacts of COVID-19 have been felt in other ways which may make these numbers a little misleading.

For example, it is well established that women in general tend to be employed is less secure work, and in many cases in caring roles (careworkers, nurses, shopworkers and in schools), which have been at the frontline of COVID-19. And this effect is compounded when gender intersects with other protected characteristics. Therefore, research has found that the crisis has had:

…a disproportionate impact on women, but that impact is worsened for women from particular backgrounds: for instance, black and racialised women, disabled women, women with caring responsibilities, and LGBT women.

This is in line with evidence from elsewhere. For example, research in Scotland has found that:

The COVID-19 crisis has already been shown to be impacting disproportionately on women as a result of occupational segregation, their over-representation in low paid and insecure employment and in unpaid work.

Perhaps the most noticeable effect on many was the additional childcare required with school closures. Research has identified that women did more of the additional childcare than men, independently of their work status. This means that ‘many women are left juggling work with (a lot of) childcare’.

Recovery

Before lockdowns began, the assumption was that there would be a bounce back as restrictions eased. This has been the case, but there is concern that the bounce back will be smaller than hoped. The course of recovery is unknown, but there are many complex factors at play. For example, according to some forecasters, perceptions of how governments handled the crisis could influence people’s behaviours, with repercussions for the economy. For example, Oxford Economics stated that:

…some signs show that perceptions of the UK and Spanish governments’ mishandling the crisis have resulted in businesses and households reverting to pre-COVID behaviours more slowly than elsewhere. If this is the case, it could undermine the strength of their economic rebounds after the initial bounce in post-lockdown growth fizzles out.

In relation to jobs, EY has forecast that, while the initial labour market disruption in NI was lower than in RoI, it will take longer for employment to recover to 2019 levels. Notably, its August projections suggest that in only 6 of 18 sectors will employment recover before 2025, compared to 11 of 18 sectors in RoI.

Looking forward, then, it appears to be crucially important that policy interventions are designed to help ensure that those groups (i.e. women, especially those from minority ethnic or LGBT communities) which are already more marginalised in the NI economy do not become even more so. To an extent this issue has been recognised in public discourse, and there has been something of an emphasis on skills. Time will tell how successful such interventions might be.