Please note: we have posted a new version of this blog article using the most recent HMRC annual trade data, see here.

This blog post uses annual data from the HM Revenue and Customs’ (HMRC) Regional Trade Statistics [Download: Excel file] to provide an overview of Northern Ireland’s current position with regard to trade in goods. It also outlines how a recent change in methodology has impacted previous analyses of Northern Ireland’s trade relationship with the EU.

Growing Northern Ireland’s export base has long been a key pillar of the Executive’s economic strategy. The Executive’s 2012 Economic Strategy’s ‘path to competiveness’ was predicated on ‘a larger and more export-driven private sector’ leading to increased employment and wealth.

In March 2016, the Department for the Economy (DfE) published ‘Export Matters’, an action plan aimed at increasing the value of exports and external sales outside of Northern Ireland by 80% by 2025.

Most recently, the DfE released ‘Economy 2030 – draft industrial strategy’, this too had a global focus, prioritising ‘succeeding in global markets’ among it pillars for growth. Underpinning this desire to succeed in global markets is a drive ‘value of sales by local businesses made outside Northern Ireland’.

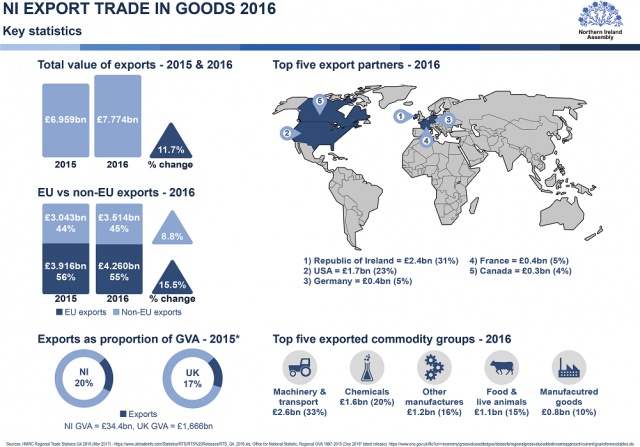

Export performance

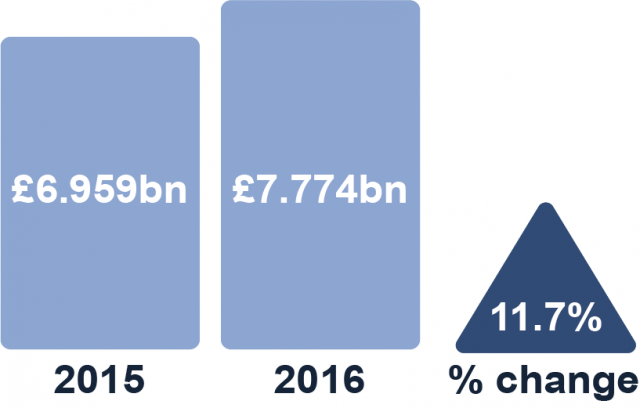

In 2016, Northern Ireland goods exports were valued at £7.774 billion (bn). This represented an increase of 11.7% on the previous year when exports were valued £6.959bn.

As in previous years, the largest market for Northern Ireland’s exports in 2016 was the EU (see the infographic, above), which was the destination of exports valued at £4.260bn, or 55% total exports value. Both EU and non-EU exports saw year-on-year growth between 2015 and 2016. EU exports grew by 15.5% in this period, whereas non-EU grew by 8.8%.

Exports contributed to 20% of NI’s gross value added (GVA) in 2015 (latest year for GVA data at the time of writing). This was above the UK as a whole, where exports accounted for 17% of GVA.

Key markets and commodity groups

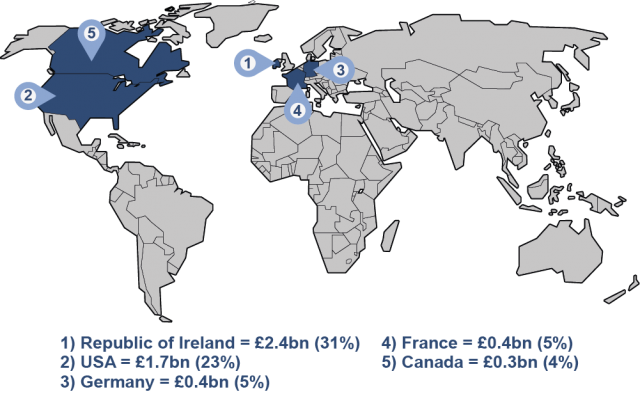

The EU as a trade bloc is the destination for more than half of NI’s goods exports. On a country by country basis, however, the Republic of Ireland (RoI) remains our key export partner. In 2016, goods exports to the RoI were valued at £2.4 billion, equivalent to 31% of total goods exports value and approximately 56% of the value of goods exported to the EU. The US was Northern Ireland’s second most significant export partner in the same year. Goods exports to the US were valued at £1.7 billion in 2016, equivalent to 23% of total exports, and 49% of non-EU exports (see Figure 2). It is important to note too, exports to the US grew by 41% year-on-year between 2015 and 2016.

Machinery and transport equipment was Northern Ireland’s number one export commodity group in 2016. Exports of this type were valued at £2.6 billion, or 33% of total goods export value.

Changes to HMRC’s regional trade methodology

The methodology used by HMRC to compile data on regional trade in goods has recently undergone a change. This change has altered the way trade has been allocated to UK regions since 2013. Commenting on the underlying rationale behind the methodological change HMRC has stated:

The previous allocation methodology allocated trade to a region based on where the headquarters of a business is located for VAT/Customs purposes, supplemented an historic survey.

…We have moved to the methodology used in the Annual Business Survey by the ONS, which uses data in the Inter-Departmental Business Register (IDBR). This allocates the trade of a multi-branch business to different regions based on a proportion of their employees in each region.

In January 2016, the Assembly Research and Information Service used HMRC regional trade to analyse NI trade with the EU and Rest of World (RoW) (see NIAR 32-16 and Addendum NIAR 88-17). This analysis drew two major conclusions with respect to trade over the period 2004 to 2014, namely:

- That the EU is Northern Ireland’s largest export market; and,

- That Northern Ireland exported more to the EU than it imported from it on an annual basis over the period examined with the exception of 2012.

The methodological change introduced by HMRC has not impacted the first of these conclusions. The EU remained Northern Ireland’s largest export partner in this period. As noted above, this continues to be the case, with the EU accounting for 55% of total exports as of 2016.

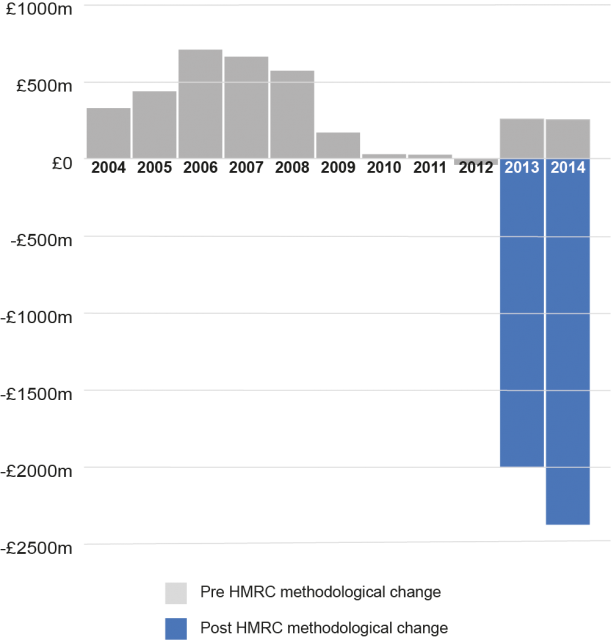

The second of these conclusions has, however, been affected by the methodological change. HMRC’s new methodology has led to a significant increase in total imports into Northern Ireland, with all of this net increase in imports coming from the EU. As illustrated in Figure 3, Northern Ireland’s balance of trade with the EU during 2013 and 2014 has shifted from a trade surplus, whereby NI exported more to the EU than it imported, to a large trade deficit, whereby NI is now shown to have imported significantly more from the EU than it exported to it in both 2013 and 2014.

From a practical perspective, this change substantially alters the analysis of NI’s trading relationship with the EU. Under the old methodology, the data shows that trade between Northern Ireland and the EU resulted in £243 million net entering the NI economy in 2013. This fell slightly to £239m in 2014. Under the new methodology, the same analysis shows £1.9 billion net pounds leaving the Northern Ireland economy through trade in 2013, rising to £2.2 billion in 2014.

It is evident from more recent data, which includes figures for 2015 and 2016, that this trend towards an increasing trade deficit has continued. HMRC’s data for 2015 shows Northern Ireland’s balance of trade with the EU to be in deficit to the value of £2.9 billion, with 2016 data showing a deficit of £3 billion.

Conclusion

HMRC’s data on regional trade shows that Northern Ireland exports grew by 12% year-on-year between 2015 and 2016. The largest proportion of these exports (55%) went to the EU, with the RoI continuing to be the most important single country destination for Northern Ireland exports (31% of total exports in 2016). The data shows the US to be the second largest single country destination for Northern Ireland exports (23% of total exports in 2016). It also shows that exports to this market grew substantially (by 41%) between 2015 and 2016.

Despite changes to HMRC’s regional trade allocation methodology the EU, as a trading bloc, remains Northern Ireland’s most significant exports partner. However, the same methodological change has fundamentally altered Northern Ireland’s trade balance with the EU in 2013 and 2014, transforming small trade surpluses into significant trade advantages (a trend which continues into 2015 and 2016). This development is likely to be important within the context of Brexit and any future attempts to assess key potential impacts of proposed/actual future trading relationships between the UK and the EU.

NB: This post was amended on 30 August 2017 to include unrounded figures and to correct a typo in the previous version.