This blog article is the second of two providing updates on NI’s public finances: Update no.1 looks back to a number of recent developments. This article looks forward to what is coming over the weeks ahead.

There are two key forthcoming events that will shape the fiscal future of NI: the UK Chancellor’s Spending Review; and, the Executive’s Budget Process 2021-22. These are considered in turn.

1. UK Spending Review

Under NI’s Public Finance Framework (i.e. the rules governing taxation and expenditure), the outlook for NI public finances and future Executive Budgets will be primarily informed by the forthcoming UK Spending Review (SR). This is currently due to conclude in the autumn, with the Chancellor’s announcement on spending limits for central government departments and the UK’s devolved administrations. It is anticipated that the Chancellor will set UK departmental resource budgets for the years 2021-22 to 2023-24 and their capital budgets for the years 2021-22 until 2024-25, along with devolved administrations’ block grants for the same periods. But like everything else in the COVID-19-19 era, this may be subject to change…

Could change to the Chancellor’s plans arise due to existing unprecedented uncertainty? The Chancellor’s March 2020 Budget announcement had to change in response to COVID-19. It is interesting that when announcing the SR, the Chancellor did not fix a set spending envelope. Instead, he merely confirmed that departmental spending (both capital and resource) “will grow in real terms” across the SR period.

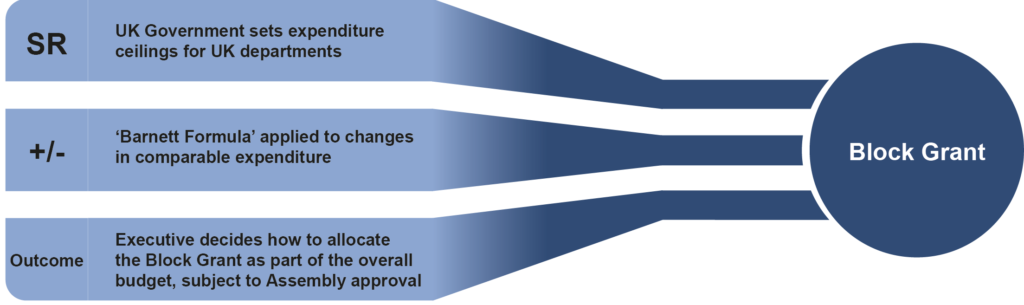

In any case, under the current devolved financial arrangements, exactly how the SR informs future Executive Budgets will depend upon which UK departments gain or lose funding, and how these compare to NI’s devolved spending areas. (See Figure 1.)

It will also be interesting to see the outworking of the SR’s priorities, related requirements for department returns, and how they impact UK Government decisions. In particular, for example, what will it mean for:

Departments…to fulfil a series of conditions in their returns, including providing evidence they are delivering the government’s priorities and focussing on delivery.

Moreover, there has been some criticism of the UK Government’s plan to set allocations for three years, and that it should set a single-year SR until there is more certainty. For example, an article by the Institute for Government stated:

Heightened uncertainty around the economy and public services mean that the government’s decision to hold a three-year spending review is the wrong one and should be reversed.

The current timetable is for the SR to be published in the Autumn, alongside an interim report of an ongoing Net Zero Review in relation to carbon emissions. This may be significant, because although COVID-19 is currently the centre of attention, other very important issues, such as climate change still need to be addressed. Any policy initiatives taken to address climate change are likely to need funding, so the Review may lead to further public expenditure pressures at a time when COVID-19 and the economy still require support. The UK Government’s decisions on how to balance those competing factors will inform the spending envelope for NI.

2. Forthcoming NI Budget Process 2021-22

The Executive’s current Budget 2020-21 expires on 31 March 2021. There is therefore a need for a NI budget process to set spending for 2021-22, and perhaps beyond that. The New Decade New Approach agreement included commitments for the Executive to move towards multi-year budgets. Whether that occurs at this or a later stage remains to be seen.

In the meantime, an indicative timetable for the forthcoming NI Budget Process is at Figure 2 below:

| Key action | Date |

| Departmental returns to DoF | 16 September 2020 |

| Conclusion of Departmental Engagement | Start October 2020 |

| Ministerial Statement to Assembly on Treasury Budget Controls | TBC Post SR |

| Ministerial Bilaterals | TBC 2 weeks Post SR |

| Draft Budget Paper to Executive | TBC 4 weeks Post SR |

| Draft Budget to Assembly | TBC 5 weeks Post SR |

| Budget Consultation Closes | TBC Early 2021 |

| Budget agreed by Executive | TBC Early 2021 |

| Assembly Debate and Vote | TBC Early 2021 |

Figure 2: Indicative Executive Budget 2021-22 timetable (Source: DoF Letter to NI Assembly Committee for Finance, dated 3 September 2020)

The timing of the SR announcement will clearly be crucial to the devolved processes. The timetable shown in the table above is highly contingent upon the date of that announcement.

“Autumn” can, of course, be interpreted broadly and the timing of UK fiscal announcements can vary, for example:

- SR 2015 was announced on 25 November;

- Autumn Budget 2017 was announced on 31 October; and,

- Autumn Budget 2019 – planned for 6 November – was cancelled altogether.

The standard NI Budget Process is shown in Figure 2. Although some work can clearly be done by departments in advance of the Spending Review, it is obviously very difficult for the Executive to produce a draft budget until it knows the size of the fiscal transfer (block grant) it will receive from the UK.

For Assembly committee scrutiny processes, timings matter, and the difference of a few weeks could be significant in relation to their ability to fulfil their roles fully. Statutory Committees have codified roles under the Belfast/Good Friday Agreement, which states:

The Executive Committee will seek to agree each year, and review as necessary, a programme incorporating an agreed budget linked to policies and programmes, subject to approval by the Assembly, after scrutiny in Assembly Committees, on a cross-community basis.

In addition, section 29 of the NI Act 1998, as amended, gives Statutory Committees the following functions:

…to advise and assist each Northern Ireland Minister in the formulation of policy with respect to matters within his responsibilities as a Minister.

For those Committees to discharge these scrutiny, advisory and assistance functions, they need time to consider draft budget proposals made by the Executive. The available time for stakeholders and wider civic society to comment upon the Executive’s draft budget will also necessarily be determined by these same factors. But, as noted above the Executive will not know its spending envelope until the announcement of the SR, so the timetable shown in Figure 1 will be affected by the timing of the UK Chancellor’s statement.

Whatever decisions are taken will impact NI society, and at a time when life is very different from how it was pre COVID-19. Decisions taken in the near future – at both NI and UK levels – will have consequences for the future. Input from MLAs, wider civic society and other stakeholders is therefore likely to be of great importance.