The summer months are often quiet times for NI public finances. But, like so much else about 2020, this summer has been a little different. This blog article is the first of two providing updates on NI’s public finances: it looks back to a number of recent developments. Update no.2 (Autumn 2020) follows on from this, and looks forward to what is coming over the weeks ahead.

On 15 July, the current UK Chancellor told the Treasury Select Committee there are “tough choices ahead” to get the public finances on a sustainable path. On 21 July, he announced that a Spending Review will conclude in the autumn, and repeated his ‘tough choices’ mantra. This language is far from new. Back in June 2010, the then UK Chancellor introduced an ‘emergency budget’ based on “tough choices”. This heralded a long period of austerity from which the UK was about to emerge… and then the COVID-19 crisis hit. So are we facing Poundhog Day; a re-run of the last decade of austerity?

This blog article tries to help answer that question. It follows June’s blog article – Fiscal ball gazing: How could the COVID-19 crisis affect NI’s public finances? which looked at what might be ahead. Since June, two significant UK-level developments which impact on NI: the Chancellor’s 8 July Summer Statement and the announcement of a Comprehensive Spending Review. This article addresses the former, the latter is addressed in Update no.2, to be published shortly.

It is useful to take stock of where we are and how we got here. Numerous recent UK and NI publications impact to some degree on NI’s public finances. Table 1 provides links to those various publications, and briefly states their purpose.

Looking back down the track

| DATE | WHAT HAPPENED? | WHAT DID IT DO? |

| 11 March 2020 | UK Chancellor budget 2020 presented to Parliament. | Set out the UK Government’s initial COVID-19 response, including announcement of £210 million for NI |

| 31 March 2020 | Minister of Finance budget statement to the Assembly. | Set out the Executive’s plans for rates and departmental allocations for 2020-21; made limited initial COVID-19 spending response. |

| 9 April 2020 | Minister of Finance written ministerial statement to the Assembly. | Detailed further Executive COVID-19 spending response. |

| 5 May 2020 | Executive Budget 20-21 document published. | Set out more detail on the Executive’s departmental allocations 2020-21 and Covid-19 response (as at 20 April 2020). |

| 19 May 2020 | Department of Finance COVID-19 allocations published. | Updated the COVID-19 allocations figures from the Executive Budget 20-21 document. |

| 30 June 2020 | Minister of Finance June Monitoring Round statement to the Assembly. | Announced allocation of funding carried forward from 2019-20 under the Budget Exchange scheme; additional COVID-19 funding from the UK Treasury; and, outcome of Covid-19 departmental reprioritisation exercise. |

| 8 July 2020 | UK Chancellor’s Summer Statement to UK Parliament. | Announced a number of fiscal and other policy measures to support the economy; and, summarised COVID-19 measures taken up to that date. |

| 21 July 2020 | UK Chancellor announced Spending Review 2020 | Announced Spending Review to be published Autumn 2020. |

| 28 August 2020 | Department of Finance Updated COVID-19 Allocations published. | Updated the COVID-19 Allocations from the 19 May publication. |

| 2 Sept 2020 | NI Audit Office Overview of NI Executive’s response to Covid-19 published. | Summarised main Executive responses to Covid-19 (i.e. costs over £1 million). |

Figure 1: NI public finance: 2020 timeline

If you arrived from another planet, it would arguably be pretty clear from Figure 1 that these are extraordinary times. It is uncommon to have so many public finance-related publications and ‘fiscal events’ in a six-month period. This is a function of COVID-19: the need to quickly resource public health, and support the economy.

Figure 2 shows the recent expansion of NI public finance. Not all of this is spent yet: some of what is included is based upon forecasts of future spending. As things currently stand these measures may total more than £2.2 billion at the final reckoning.

For context, the NI discretionary DEL budget for 2019-20 was just over £12.5 billion. So, COVID-19 may result in departmental spending increases approaching 1/5 of that amount. As the longer-lasting damage to the economy becomes clear, there will be further increases in welfare expenditure over pre-pandemic levels.

| Department | £ million |

| Agriculture, Environment and Rural Affairs | 30.3 |

| Communities | 98.3 |

| Education | 109.2 |

| Economy | 406.3 |

| Finance | 316.6 |

| Health | 382.5 |

| Justice | 25.2 |

| Infrastructure | 117.2 |

| The Executive Office | 0.5 |

| Centrally held by Executive

(pending development of departmental proposals/costs) |

807.7 |

| TOTAL | 2,293.6 |

Figure 2: Executive allocated COVID-19 funding 2020-21 (Source DoF 2020)

Figure 2 relies on the Department of Finance (DoF) publication in August 2020. Readers should note the NI Audit Office also published COVID-19 allocation data, and the figures differ slightly. Differences may be explained by – among other things – the timing of data collection and because some of the departmental allocations are based upon their officials’ projections. In addition, disclosure in the NIAO report ‘is limited to NI government department initiatives estimated to cost in excess of £1 million each.’ Further note, these allocations will likely change again.

Figure 2 shows there is still a considerable amount of funding to be allocated and released by the Executive i.e. over £800 million; more than one-third of the total.

The Summer Statement

The UK Chancellor’s Summer Statement announced some fiscal and other policy interventions in response to the pandemic taking effect throughout 2020-21. Future years will be informed by the Chancellor’s ongoing Spending Review and the forthcoming NI Budget process (see Update no.2).

The UK Chancellor’s ‘Plan for Jobs’

The Summer Statement announced various temporary measures which the UK Government hopes will:

…support employment through the recovery period, and by doing so will help to minimise structural damage to the economy and public finances.

As such, the 8 July announcement was part of the emergency fiscal response to COVID-19.

Measures include:

- Job Retention Bonus;

- Kickstart Scheme;

- Boosting worksearch, skills and apprenticeships;

- Reduced rate of VAT for hospitality, accommodation and attractions; and,

- Eat Out to Help Out.

The Economist commented on the fiscal cost of these announcements:

The chancellor spoke for only half an hour and yet still managed to announce around £30bn ($38bn) in new measures, some 1.4% of pre-crisis GDP, for the current fiscal year—a huge deal, in normal times.

Figure 3 below shows why the Chancellor believed such a large injection is necessary, demonstrating the huge scale in the fall in economic activity:

| The 5 largest falls in quarterly GDP since records began in 1955 | ||

| Date | GDP% drop | Significant Factors |

| 2020- Q2 | -20.4 | Covid-19 |

| 1974 – Q1 | -2.7 | Miners’ strikes |

| 1958 – Q2 | -2.4 | During 1958 economic downturn |

| 2020 – Q1 | -2.2. | COVID-19 |

| 2008 – Q4 | -2 | During the 2008 to 2009 economic downturn |

Figure 3: UK Gross Domestic Product (GDP): Covid-19 related drop, relative to past falls (Source: Public Finance 2020)

It would scarcely be an exaggeration to note that the drop in UK GDP in 2020-Q2 was extremely dramatic. Yet, as the Economist went on to explain, inevitably, some of the official economic forecasts from earlier in the year were a little “off”:

…the initial bounce-back in activity, as measured by visits to workplaces and shops, has been slower in Britain than in other rich economies. Both the OBR and the Bank of England appear to have been too pessimistic in their respective April and May forecasts on the scale of the plunge but independent forecasters reckon that both were too optimistic about the strength of the recovery. The hole is not as deep as the official forecasters feared but climbing out of it may take longer than they hoped.

While the data in Figure 3 are established national statistics, the precise future path is, of course, unknown.

The consequences of economic contraction

This fall in economic activity obviously has, and will continue to have, fiscal consequences, primarily:

- Collapse in tax revenue; and,

- Huge expansion in public expenditure.

And the inevitable consequence of the above is burgeoning public debt, albeit at low interest rates. The latest UK public finance data shows:

The coronavirus (COVID-19) pandemic has had an unprecedented impact on borrowing. Provisional estimates indicate that the £150.5 billion borrowed in the first four months of the current financial year (April to July 2020) was almost three times the £56.6 billion borrowed in the whole of the latest full financial year (April 2019 to March 2020).

The ONS has noted that falling revenues are also due to UK Government policy choices, such as self-assessment deferrals:

Self-assessed Income Tax receipts were £4.8 billion in July 2020, £4.5 billion less than in July 2019, because of the government’s deferral policy.

This means that some revenue collection is delayed, rather than lost to the Exchequer altogether. The speed and strength of the economic recovery will determine whether some of this must be written off.

Where relating to devolved matters, the Summer Statement measures provided the Executive with £162 million in additional funding. However, it is important to note that £33 million of this funding had already been announced as support for the Arts.

According to the NI Minister of Finance, this response was welcomed, but did “not go far enough”. On 24 July, however, the Treasury confirmed that NI will get an additional £600 million in COVID-19 funding this year, bringing the total COVID-19 response for 2020-21 to £2.2 billion. As shown in Figure 2 above, this has not yet all been allocated by the Executive.

UK-level effects

It is important to remember that Figure 2 relates to devolved expenditure, and funds activities and programmes by NI departments. Other policy-related costs will accrue at the UK level, with financial implications for NI. For example, revenue is non-devolved under the devolved financial arrangements. The Chancellor’s UK-wide VAT reduction to the rate on supplies of food and non-alcoholic drinks from restaurants, pubs, bars, cafés and on accommodation and admission to attractions across the UK. Value Added Tax (VAT) is collected by the UK Government, not the Executive.

The Summer Statement forecasted the potential cost of this temporary VAT measure at around £4.1 billion in reduced receipts. All other things being equal, less finance will be available for public expenditure by UK departments and in turn for the devolved administrations’ block grants , as determined by Treasury under the Barnett formula. Time will tell how much this will occur.

Eventually, COVID-19 will become a less clear and present public health danger. In the meantime, the UK Government is facing decisions on a number of things, including how to deal with increasing borrowing, e.g. tax more, spend less, or some balance of the two. The UK devolved governments are grappling with such decisions in line with their respective fiscal powers. This will continue for the medium-to-long-term. The UK Government in particular must develop a debt management strategy to satisfy creditors and international credit-rating agencies.

This is important because the UK’s credit rating affects its cost for borrowing, and so has ‘knock-on’ consequences for devolved public finances. UK debt dynamics may translate to NI through the mechanisms noted in Fiscal ball gazing: How could the COVID-19 crisis affect NI’s public finances? (i.e. via the forthcoming UK Government Spending Review and the Barnett Formula). If the UK faces higher future borrowing costs, this will presumably impact the mix of spending/taxation.

On the other hand, as the Irish Fiscal Advisory Council (IFAC) recently noted interest rates are currently so low that debt dynamics can be favourable: although borrowing has increased, at current interest rates it is relatively cheap. This is sensitive to interest rates remaining low, which the IFAC says “should not be taken for granted.” If rates rise, so will future debt-servicing costs. Of course, there are various fiscal options available to the UK Chancellor in place of, or alongside, cutting future expenditure. For example, the media reported in July that he was considering an online sales tax as part of the Treasury’s review of business rates.

Other measures

The Summer Statement introduced a ‘Stamp Duty holiday’, until 31 March 2021, on sales between the current threshold of £125,000, up to £500,000.

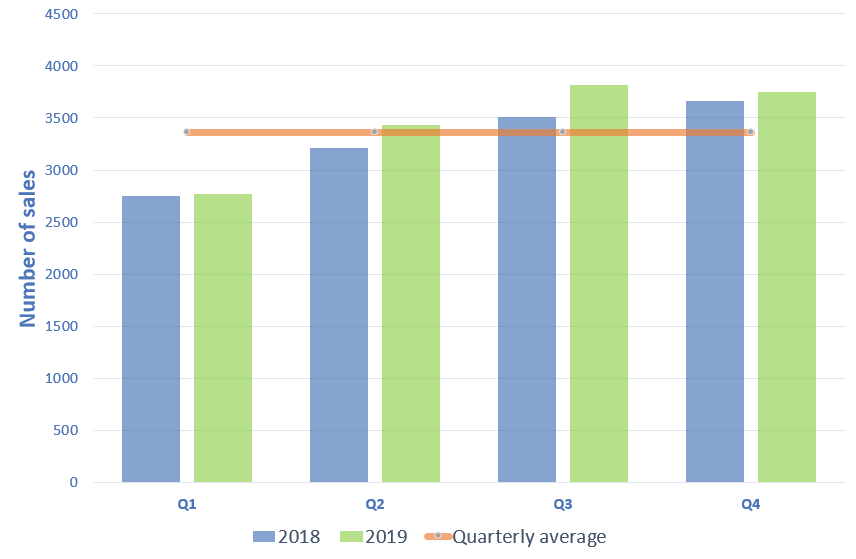

Figure 4 shows data supplied by Land and Property Services relating to domestic dwellings in the NI Valuation List. Looking across each quarter in both 2018 and 2019, there was an average of just over 3,350 house sales within those threshold values. Assuming house prices have not changed dramatically since then, and further assuming an average sales, the holiday could benefit around 10,000 NI purchasers between July 2020 to March 2021.

House buyers benefitting from such a tax break should have more disposable cash for other things. This may stimulate more demand in the local economy. Alternatively, those house buyers could choose to save that available cash, or spend it on imports, meaning it would leak out of NI. Regardless, this demand-oriented policy seems designed to stimulate housing market activity; but it is not without critics. One notes:

Evidence from previous stamp duty holidays shows that it is unlikely to increase sales volumes and will merely bring them forward.

In other words, the temporary Stamp Duty reduction may not encourage more house sales in total. Rather, it may simply encourage those who might otherwise have moved in summer 2021 to complete earlier, i.e. before 31 March.

Much about this remains uncertain. It is quite possible that housing and consumer demand will be affected by uncertainty about the future labour market, unemployment and factors relating to Brexit. In particular, it may be affected by the future implementation of the NI Protocol, following the outcome of the Internal Market Bill currently under consideration in Westminster.