Northern Ireland’s post-Brexit goods trade

This blog article complements the Assembly Research and Information Paper Internal Market Act 2020 and the Protocol on Ireland/Northern Ireland. It explains Northern Ireland’s post-Brexit trading arrangements. including how those arrangements have been defined by a range of legal instruments.

Following the United Kingdom’s (UK) exit from the European Union (EU), a range of legal instruments have affected Northern Ireland (NI) goods trade. Those legal instruments include:

- The Protocol on Ireland/Northern Ireland (the Protocol);

- The Internal Market Act 2020 (IMA);

- The Trade and Cooperation Agreement (TCA) between the UK and EU; and,

- The various decisions and declarations of the Protocol’s Joint Committee

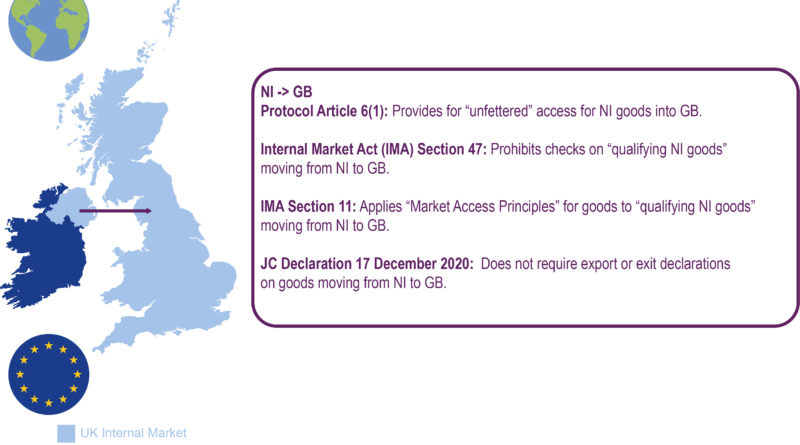

All of the above have affected the flow of goods between NI and various trade partners, including Great Britain (GB), the EU Single Market, and the rest of the world (RoW). This blog article explains the impact on those goods flows in more detail, as summarised in Figure 1, below.

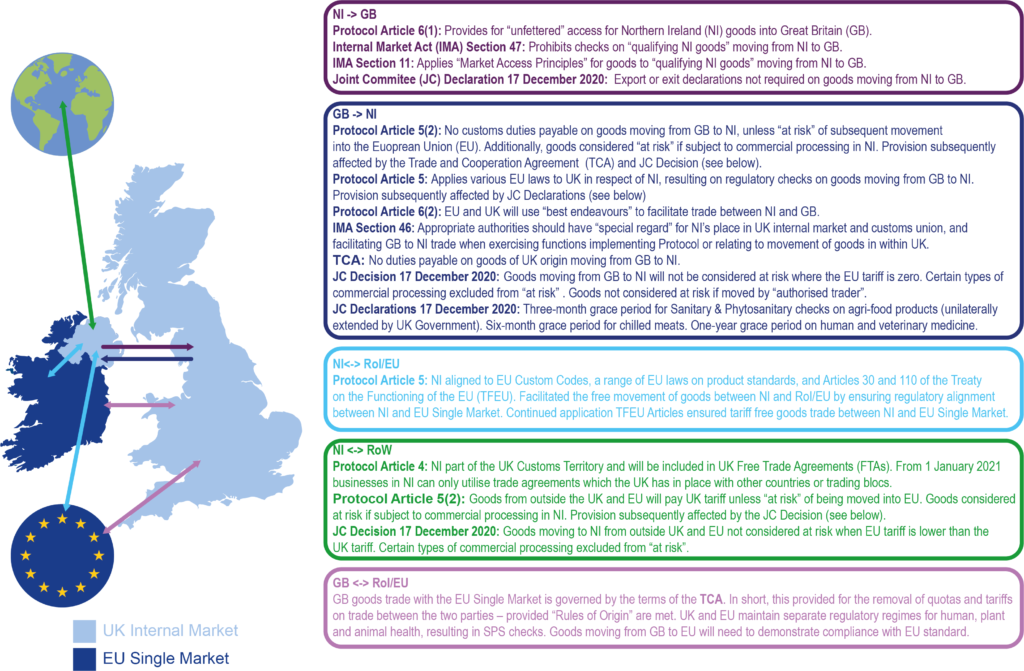

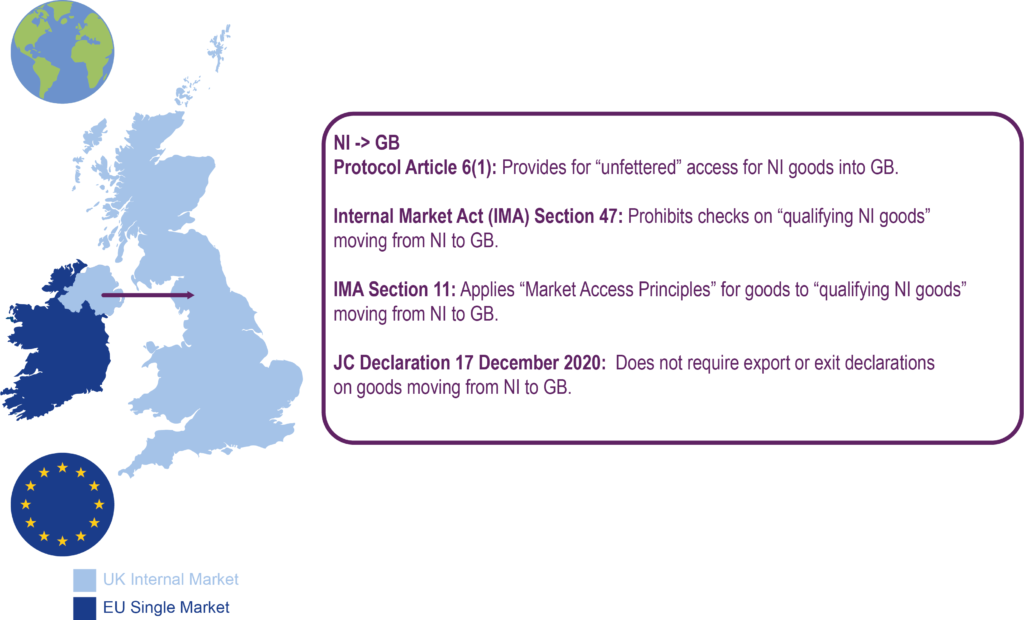

Goods trade from NI to GB

Figure 2 above examines how the Protocol, the Westminster enacted Internal Market Act 2020 (IMA) and a Joint Committee (JC) Declaration collectively work together, to ensure the ‘unfettered’ movement of goods from NI to GB. To that end, Article 6(1) of the Protocol states that nothing in the Protocol:

…shall prevent the United Kingdom from ensuring unfettered market access for goods moving from Northern Ireland to other parts of the United Kingdom’s internal market.

That provision is supported by two sections contained in the IMA. Specifically, Section 47, which generally prohibits the introduction of new checks, or the use of existing checks in a new way, on ‘qualifying NI goods’ moving from NI to GB; with some limited exceptions – for example, when such goods checks are required by UK or EU international obligations.

The other IMA provision, Section 11, ensures that the Act’s Market Access Principles for goods apply to qualifying NI goods in GB markets. That means such goods can benefit from the principles of mutual recognition and non-discrimination across the UK.

Given both Sections 47 and 11 of the IMA, ‘qualifying NI goods’ are defined as:

- Goods that are either present in NI, and not subject to customs procedures; or,

- Goods that either have undergone processing in NI and are made up of components not subject to customs procedures, or components that have successfully completed customs procedures.

In addition to the above, the unfettered access of NI goods to GB markets was supported by a JC declaration of the 17 December 2020, which ensured export and exit declarations are not required on goods moving from NI to GB.

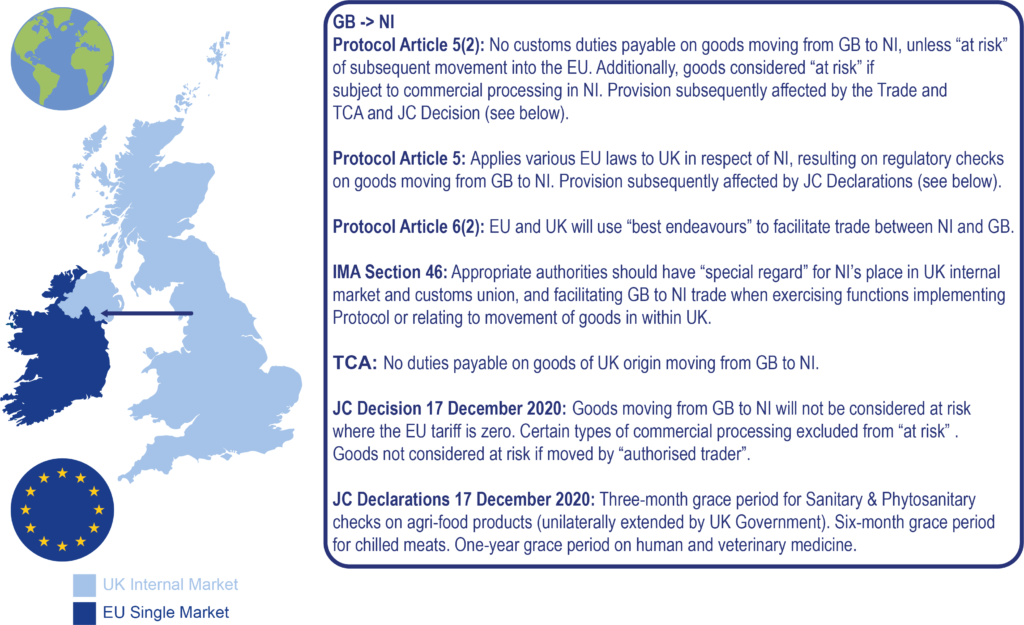

Goods trade from GB to NI

Figure 3, above, summarises the apparent outworking of the Protocol, the IMA, JC decisions and declarations, and the TCA on goods moving from GB to NI. Article 5 of the Protocol provided that no customs duties would be payable on goods moving in this direction, unless the goods were ‘at risk’ of moving into the EU Single Market. It also provided that goods would be considered ‘at risk’ of moving into the EU Single Market, if they underwent processing in NI.

The noted Protocol Article 5 provisions were subsequently modified by a JC Decision of the 17 December 2020. That Decision:

- Declared goods moving from GB to NI were not ‘at risk’ of entering the Single Market (where the EU tariff is zero).

- Excluded specific types of processing from the ‘at risk’ category; and,

- Provided that goods moved by authorised traders would not be considered ‘at risk’.

The above concept of authorised trader, also known as the ‘UK Trader Scheme‘, allows businesses moving goods from GB to NI, to self-declare that their goods are not at risk of entering the EU Single Market, if the businesses meets certain criteria. For example, for NI importers, the specified criteria include a business established in NI, with a fixed place of business in that region.

In addition to the above JC Decision, the TCA specified no duties were to be payable on goods of UK origin moving from GB to NI.

Article 5 of the Protocol also aligned NI to certain aspects of EU law, resulting in regulatory checks on goods moving from GB to NI. Those provisions were subsequently affected by JC Declarations issued on 17 December 2020, which introduced grace periods on the full implementation of specific types of checks, namely:

- A three-month grace period for sanitary and phytosanitary checks on agri-food products, later unilaterally extended by the UK government;

- A six-month grace period on checks on chilled meats; and,

- A one-year grace period on check on human and veterinary medicine.

Finally, in relation to GB to NI goods flows, Article 6(2) of the Protocol provided that:

Having regard to Northern Ireland’s integral place in the UK’s internal market, the Union and the UK shall use their best endeavours to facilitate trade between Northern Ireland and other parts of the UK, in accordance with the applicable legislation and taking into account their respective regulatory regimes as well as the implementation thereof.

This was ‘supported’ by IMA Section 46, which provided that appropriate authorities exercising any function implementing the Protocol, or relating to the movement of goods within the UK, should have ‘special regard’ for both:

- NI’s place in the UK Internal Market and Customs Unions; and,

- Trade facilitation between GB and NI.

As noted above, Section 47 of the IMA prohibits checks on goods moving from NI to GB. The IMA has no equivalent prohibition on checking goods moving from GB to NI.

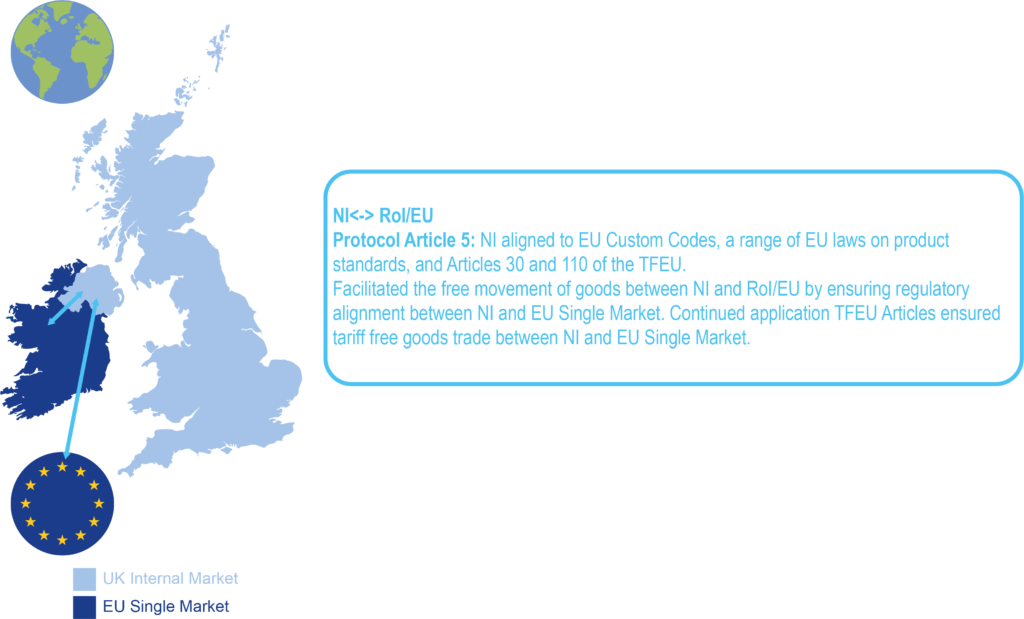

NI goods trade with the EU Single Market

Figure 4, above, summarises the Protocol’s impact on goods trade between NI and the EU Single Market. In particular, it highlights how Article 5 of the Protocol aligned NI with certain EU law. This alignment enables goods to flow between the two markets without the need for checks or tariffs.

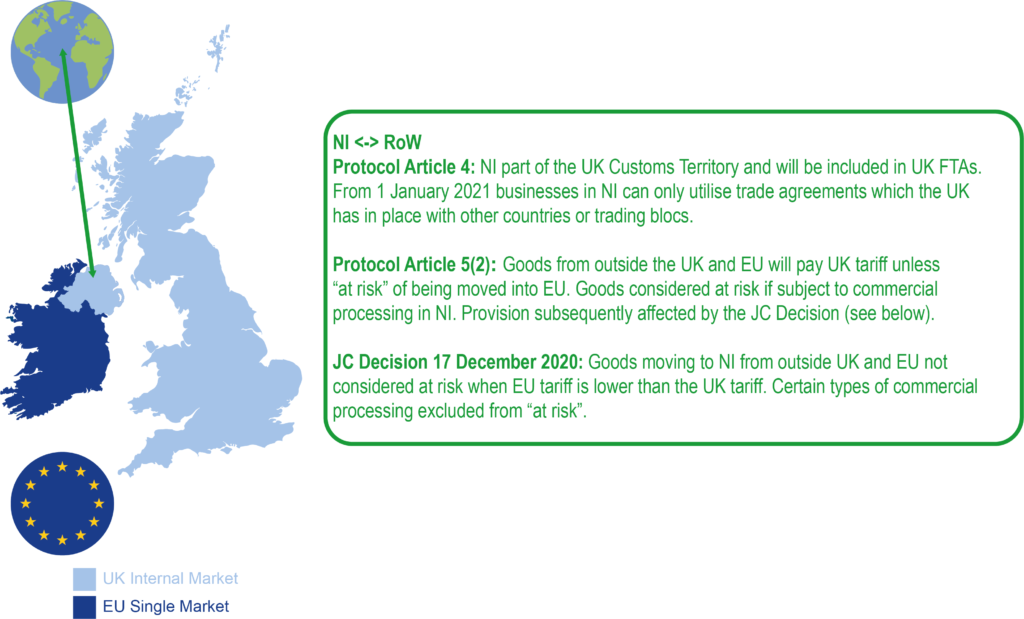

NI goods trade with the Rest of World

Figure 5, above, summarises the impact of the Protocol on goods trade between NI and the Rest of the World (RoW). Article 4 of the Protocol provides that NI is part of the UK Customs Territory and is to be included in any UK Free Trade Agreements (FTAs). There is no equivalent provision in the Protocol enabling NI to benefit from EU FTAs. As such, since 1 January 2021 businesses in NI can only utilise trade agreements that the UK has in place with other countries or trade blocs.

Additionally, Protocol Article 5(2) provides that goods moving to NI from outside of the UK and the EU would pay the UK tariff, unless they were ‘at risk’ of movement into the EU Single Market. It also provided that goods that were processed in NI would be considered ‘at risk’ of movement into the EU. A JC Decision on the 17 December 2020 modified that position. The Decision declared goods moving into NI from outside the EU and the UK would be considered at risk only when the EU tariff is lower than the UK tariff. It also excluded certain types of commercial processing from the ‘at risk’ category.

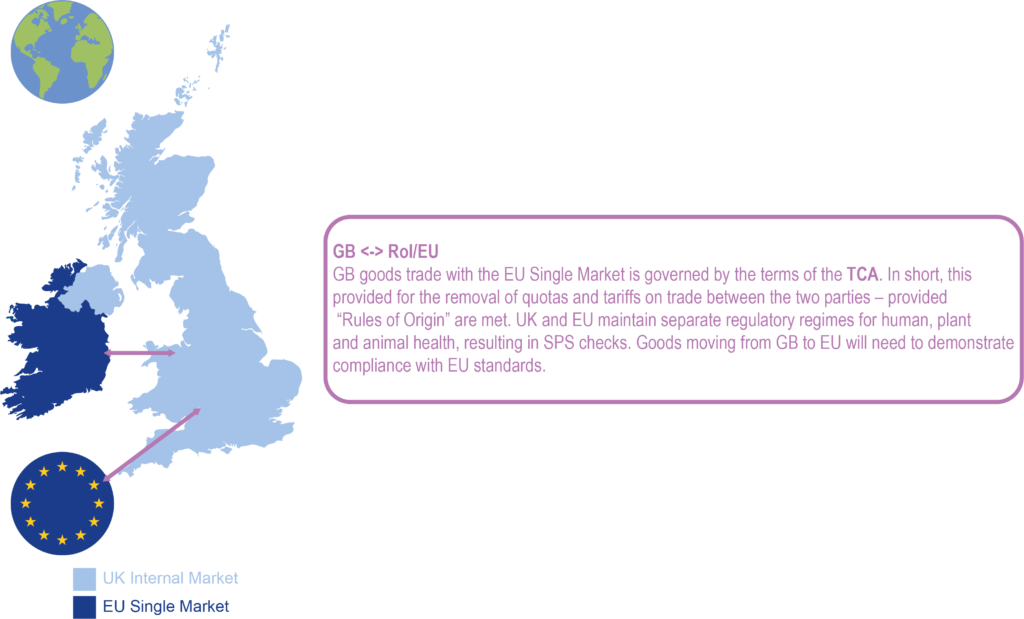

GB trade with the EU Single Market

For comparative purposes, Figure 6 summarises post-Brexit goods trade arrangements between the GB and the EU Single Market. That trade is governed by the terms of the Trade and Cooperation Agreement between the UK and the EU. Amongst other things, that Agreement provided for the removal of quotas and tariffs on trade between the two parties. It did not provide for the removal of checks on goods, including sanitary and phytosanitary checks. Nor did it remove the need for goods moving from GB to the EU, to demonstrate compliance with EU standards.

Apparent high-level advantages and disadvantages of NI’s current trading arrangements

The impact of the Protocol, the IMA and Joint Committee decisions and declaration ensures that NI’s trading arrangements are different than other parts of the UK. That impact has apparent advantages and disadvantages. At a high-level, those apparent advantages include:

- NI is in a unique position in that it has ‘unfettered’ access to both the UK Internal Market and the EU Single Market. With regard to the EU Single Market, that applies to goods sold to that Market and bought from it;

- Grace periods on GB to NI checks have been secured, (albeit time bound); and,

- NI can benefit from current and future UK Free Trade Agreements with third countries.

On the other hand, high-level apparent disadvantages include:

- Goods moving from GB to NI are subject to checks;

- Grace periods on those checks are time bound (to expire during 2021);

- NI no longer benefits from the EU FTAs with third countries; although the UK Government has secured FTAs with some of the countries, it previously had a FTA as an EU Member State.

Potential initial questions and unknowns

A number of issues appear to arise from the above context:

- What impact will ‘unfettered’ access to the UK Internal Market and EU Single Market have on NI external sales and Foreign Direct Investment?

- What impact are checks on goods moving from GB to NI having on consumer and component prices; and how will the end of the grace periods impact in those areas?

- Will grace periods secured be extended?

- What is meant by ‘special regard’ in the context of Section 46 of the Internal Market Act 2020 (IMA)?

- The UK Government views that the current definition of ‘qualifying NI goods’ as a ‘bridge to a longer lasting regime’, and has stated its intention to develop a new definition in 2021. What will the final definition of ‘qualifying NI goods’ be?

- What level of processing is required to ensure a good qualifies as a NI processed product?

- NI businesses can no longer benefit from EU FTAs. It is unclear what impact this will have on NI business. Particularly, those NI businesses that supply components to EU Member State business who in turn use those components in products that they sell into third countries with which the EU has a FTA.

- In relation to all the above, what representations have the Executive and/or individual departments made to the UK Government or other?